OUR BUYERS CLOSED TODAY!!! Oakland Hills...

I am thrilled to share that I had the absolute pleasure of handing over the keys to my Buyers, for their new dream home today! Here's to a lifetime of cherished memories in their new abode!I am deeply grateful for their dedication, their hearts and their goodwill. And for their trust in me.I also want to take a moment to applaud the incredible team who made this possible. A huge shoutout to everyone involved in bringing us to this incredible milestone: the listing agent and her team, the escrow team, the lender team, the contractor, the insurance team, my transaction coordinator, and countless other dedicated professionals. Their hard work, collaboration, and kindness throughout this process have been truly commendable. It's been an absolute pleasure working with such a fantastic group!#oaklandhills #oaklandhomes #oaklandrealestate #homebuying

Read MoreOur Buyer is in Contract for a Vallejo Fourplex!

Our Buyer is UNDER CONTRACT! Cool Victorian Fourplex in Vallejo! I am so excited for my client and I'm looking forward to a smooth transaction and giving him the keys a few weeks from now!

Read MoreYour Weekly Market Update - April 9, 2024

Good afternoon! I hope you’re having a great spring day! It’s time for our weekly update once again. As always, if you have any questions or need further clarification, please don’t hesitate to reach out. Also, please feel free to share this update with anyone you know who might find it beneficial. INTEREST RATES Conventional: 6.5 – 6.99% (depending on loan amount) - rates hold from last week Jumbo: 6.75 – 6.875% (depending on loan amount) - rates hold from last week FHA: 5.99% - lower than last week VA: 5.99% - lower than last week Conventional Investment: 7.25% These rates are quoted by JVM Lending. Buyer demand continues to strengthen as we move through the spring season, and while there has been a slight increase in the number of available homes on the market compared to last week, the demand still outweighs the supply. This indicates that it’s still very much a strong Sellers’ Market in the San Francisco Bay Area.With the new CalHFA loan program now available for applications, we anticipate more pending sales in the near future as more Buyers can afford homeownership with this 0% down program. If you would like more information on this program, please let me know! REAL ESTATE MARKET SNAPSHOTAlameda County as of 4/9/2024 # of New Properties on Market Last 7 Days: 434 (up from last week) # of Properties Under Contract Last 7 Days: 196 (down from last week) # of currently Available Properties: 1,451 (up from last week) Average Listing PriceSingle Family: $1.35mil (down from last week)Condos/Townhomes: $738k (up from last week)Multi-unit up to 4 units: $1.15mil (up from last week) Average Sold Price (last 30 days)Single Family: $1.6mil (up from last week)Condos/Townhomes: $815k (down from last week)Multi-unit up to 4 units: $1.1mil (up from last week) Average days on market: 12 (quicker than last week) Homes Sold in the last 7 Days: 181 (down from last week) Homes Sold in the last 30 Days: 838 (down from last month) Contra Costa County as of 4/9/2024 # of New Properties on Market Last 7 Days: 434 (up from last week) # of Properties Under Contract Last 7 Days: 206 (down from last week) # of currently Available Properties: 1,302 (up from last week) Average Listing PriceSingle Family: $1.43mil (down from last week)Condos/Townhomes: $691k (up from last week)Multi-unit up to 4 units: $1.2mil (up from last week) Average Sold Price (last 30 days)Single Family: $1.23mil (same as last week)Condos/Townhomes: $712k (down from last week)Multi-unit up to 4 units: $1.12mil (up from last week) Average days on market: 22 (quicker than last week) Homes Sold in the last 7 Days: 143 (down from last week) Homes Sold in the last 30 Days: 783 (up from last month) Marin County as of 4/9/2024 # of New Properties on Market Last 7 Days: 83 (up from last week) # of Properties Under Contract Last 7 Days: 50 (down from last week) # of currently Available Properties: 387 (up from last week) Average Listing PriceSingle Family: $3.75mil (down from last week)Condos/Townhomes: $760k (down from last week)Multi-unit up to 4 units: $3.75mil (down from last week) Average Sold Price (last 30 days)Single Family: $2.5mil (up from last week)Condos/Townhomes: $865k (up from last week)Multi-unit up to 4 units: $1.4mil (up from last week) Average days on market: 23 (quicker than last week) Homes Sold in the last 7 Days: 47 (up from last week) Homes Sold in the last 30 Days: 176 (up from last month) As always, if you are interested in information about a specific City, please reach out – I’m here to help! Feel free to contact me with any other questions you may have as well. Thank you for your attention and I wish you a wonderful and spring-filled week ahead!Best regards,Basak

Read MoreCalHFA Dream For All Loan - Homeownership with 0% down! Available to apply this Wednesday!

Attention, everyone!I have a time-sensitive announcement regarding an incredible loan program: the CalHFA Dream For All Shared Appreciation Loan!This program offers a loan covering 20% of the home purchase price for down payment and closing costs, catering to qualifying applicants, particularly First Generation Homebuyers.If you're interested in exploring your eligibility, please reach out to me immediately. I'll connect you with one of our CalHFA approved lender colleagues to initiate the pre-approval process and register.CalHFA will start accepting applications this week and will continue until April 29th. Given last year's scenario, where funds depleted within less than two weeks of opening, time is of the essence!If you know anyone else who might be interested in seeing if they qualify, please also let me know!Best,Basak

Read MoreYour Weekly Market Update - March 28, 2024

Hi everyone! I often receive inquiries about the current market conditions, so I have decided to make it convenient for everyone to get this information by providing weekly updates for you! I hope you find this information both useful and insightful. Also, please feel free to share this with anyone you know who could benefit from it as well! INTEREST RATES Conventional: 6.75% Assumes: Credit Score above 780; Owner-Occupied; Single-Family Residence Jumbo: 6.75% Assumes: Credit Score above 800; Owner-Occupied; Single-Family Residence FHA: 6.125% Assumes: Credit Score above 680; Owner-Occupied; Single-Family Residence VA: 6.25% Assumes: Credit Score above 680; Owner-Occupied; Single-Family Residence Buyer demand remains strong, while the supply of quality homes on the market remains low. Therefore, as we head into the busy spring market, being prepared is essential for success! Pro-tip: Each buyer's interest rate will be influenced by various factors such as credit score, property type, occupancy status, income, etc. And, getting pre-approved now will enable you to confidently pursue your dream home when you find it. If you are interested in connecting with an exceptional mortgage lender who understands our dynamic market, please let me know, and I'd be happy to make an introduction! REAL ESTATE MARKET SNAPSHOT Alameda County as of 3/28/2024 # of New Properties on Market Last 7 Days: 320 (up from last week) # of Properties Under Contract Last 7 Days: 259 (down from last week) # of currently Available Properties: 1,330 (up from last week) Average Listing PriceSingle Family: $1.4milCondos/Townhomes: $710kMulti-unit up to 4 units: $1mil Average Sold Price (last 30 days)Single Family: $1.5milCondos/Townhomes: $822kMulti-unit up to 4 units: $980k Average days on market: 18 (quicker than last week) Homes Sold in the last 7 Days: 214 (down from last week) Homes Sold in the last 30 Days: 860 (up from last month) Contra Costa County as of 3/28/2024 # of New Properties on Market Last 7 Days: 385 (up from last week) # of Properties Under Contract Last 7 Days: 284 (down from last week) # of currently Available Properties: 1,157 (up from last week) Average Listing PriceSingle Family: $1.6milCondos/Townhomes: $632kMulti-unit up to 4 units: $1mil Average Sold Price (last 30 days)Single Family: $1.23milCondos/Townhomes: $725kMulti-unit up to 4 units: $980k Average days on market: 23 (slower than last week) Homes Sold in the last 7 Days: 188 (down from last week) Homes Sold in the last 30 Days: 701 (down from last month) Marin County as of 3/28/2024 # of New Properties on Market Last 7 Days: 66 (down from last week) # of Properties Under Contract Last 7 Days: 71 (up from last week) # of currently Available Properties: 336 (up from last week) Average Listing PriceSingle Family: $3.8milCondos/Townhomes: $840kMulti-unit up to 4 units: $3.6mil Average Sold Price (last 30 days)Single Family: $2.3milCondos/Townhomes: $860kMulti-unit up to 4 units: $1.15mil Average days on market: 38 (quicker than last week) Homes Sold in the last 7 Days: 44 (down from last week) Homes Sold in the last 30 Days: 154 (up from last month) If you are interested in a specific City, please let me know – I would be happy to provide that for you! Please also reach out if you have any other questions. Have a wonderful rest of the week! Best regards, Basak

Read MoreCreative ways to help our buyers reach their dreams...

I am thrilled to share that my wonderful friends, and my clients, have gotten into contract to buy a beautiful home in Oakland Hills today! Their pre-emptive offer was simply irresistible, and now, we are just a few weeks away from making their dreams a reality. They are over the moon with joy, and I am equally happy for them! If you are also looking to buy a property in the Bay Area, let's have a conversation! I'd love to help you, too! Sometimes, we need to think outside the box to make magic happen!

Read MoreHOW DOES "CREDIT UTILIZATION" AFFECT CREDIT SCORE?

HOW DOES "CREDIT UTILIZATION" AFFECT CREDIT SCORE?Advice from our lender colleague, Mike Trejo of Bridgepoint FundingUnderstanding this concept can help you manage your finances more effectively and maintain a healthy credit score.What exactly is credit utilization? It's the ratio of your credit card balances to your credit limits. For example, if you have a credit card with a $5,000 limit and a balance of $1,000, your credit utilization ratio is 20%.Negative Impact:High credit utilization, or using a large portion of your available credit, can negatively impact your credit score. High utilization is a sign of financial strain and lending institutions may view you as a higher risk borrower. Aim to keep your credit utilization as low as possible. No more than 30% utilization is recommended, but 20% or lower is even better! This will help keep your credit score up.Positive Impact:Maintaining a low credit utilization ratio can positively impact your credit score. Lenders view low utilization as responsible credit management, which reflects positively on your creditworthiness. Keeping your utilization ratio low demonstrates that you can manage credit responsibly and will lead to a higher credit score over time.Here are some tips to help you manage your credit utilization effectively:- Pay your credit card balances in full (when possible) to keep your utilization low. If you cannot pay off in full, pay the balances down as quickly as you can and as much as possible.- Avoid maxing out your credit cards, even if you plan to pay them off quickly.- Consider requesting a credit limit increase to lower your utilization ratio, but be cautious not to increase your spending along with it.- Regularly monitor your credit card balances and utilization ratio to stay on top of your financial health.

Read MoreWHAT AFFECTS YOUR INTEREST RATE?

WHAT AFFECTS YOUR INTEREST RATE? Why is every Buyer's rate different? Because, it depends on: Property Type Credit Scores Down Payment Property Use Rate Lock Period Loan Type Loan Amount Fixed Period / Loan Maturity 1st / 2nd Combo Loans

Read MoreNAVIGATING THE NEW REAL ESTATE LANDSCAPE TOGETHER: THOUGHTFULLY and GRACEFULLY

Greetings everyone,I am reaching out today to address recent developments in the real estate industry that you may have heard about. Some major brokerages and the National Association of Realtors (NAR) have reached an agreement to settle litigation regarding broker commissions on behalf of home sellers. The NAR settlement piece of it is just five days old and pending court approval, and stems from the recent Sitzer-Burnett case in Missouri.In the coming months leading up to the expected procedural changes in July, there will undoubtedly be much discussion. Rest assured, I'll be closely following these developments and be available to discuss them with you in the days and weeks ahead.For now, I want to emphasize a few key points: While there may be adjustments to practices and paperwork, the fundamental process of buying and selling real estate remains unchanged. We'll adapt as needed. I'm here to support and assist you every step of the way, so please don't hesitate to reach out with any questions. It's important to approach media information critically. I'm here to help clarify any confusion and discuss the facts together. We're still in the early stages of understanding, and further clarification will come in the weeks ahead. This presents a great opportunity for us to deepen our understanding of the economic aspects and compensation structures of real estate transactions, enhancing our ability to serve as your trusted advisors. If you have any questions or would like to discuss this further, please feel free to give me a call. While I'm not providing legal advice, I can offer insights into real estate matters and potential modifications in buying and selling. I'll reach out in the coming weeks to invite you to further discussions on these changes as well.Wishing you all a wonderful week filled with grace, kindness, and effective communication. Let's continue to bring out the best in each other!Warm regards,Basak

Read MoreSPECIAL HOME BUYER WORKSHOP INVITATION

SPECIAL HOME BUYER WORKSHOP INVITATION!If you are considering buying a home in the next 12 months, then I have a special invitation for you.My friend, and our company’s President, Sharran Srivatsaa, is doing a private, invite-only masterclass on what it takes to buy a home in today’s real estate market.Topics:- The 4 key phases to every home buyer’s journey- How to utilize constantly moving interest rates to work in your favor and get the home you want (at a monthly payment that works for you)- The 3 secrets every home buyer must know in today’s market (that nobody tells you about)- The “Seller Reverse Strategy” method to understand a seller’s strategy and how you can negotiate to get the terms you want - The single most important metric that you can utilize to predict home pricesPlease let me know if you're interested and I'll set you up!

Read MoreINTEREST RATES DOWN FROM LAST WEEK and a note about WEALTH

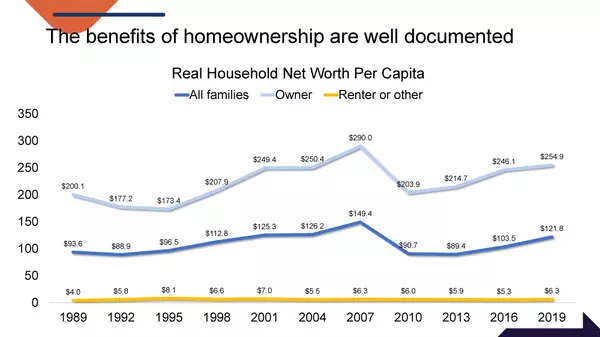

Mortgage interest rates are down from last week! Please read on to see why this is noteworthy... During our California Brokerage meeting this morning, we delved into current market conditions. Particularly in the Bay Area, it is no secret that the real estate market is continuing to thrive, even through turbulent times. There is a popular saying that holds true: The best time to buy a property was 20 years ago, and the second-best time is now! Any savings an interest rate reduction can accomplish is significantly offset by the cost of waiting to time the market which may lead to missed opportunities because prices continue to rise. Take a look at the graph below from California Association of Realtors - since 1989, the average net wealth of an American family has been in the range of $4,000 to $7,000. In contrast, the average net wealth of a family owning a home has been in the range of $200,000 to $260,000. When interest rates move down even slightly AND one has the financial capacity to buy now, it presents an even more compelling reason to consider buying now. Please also note: The interest rates we’re seeing now are very much within historic average rates. The COVID rates were an anomaly, one that is probably a once-in-a-lifetime kind. Please let me know if you'd like to talk more, whether you’re considering buying or simply want to catch up, I’d love to chat! 510.684.3939 #interestrates #mortgage #homeownership #realestate

Read MoreAttention Homeowners! EXCITING NEWS!

If we got someone else to invest in your home's renovation without you spending a penny and then you sold it for top dollar, would you want to know more about how it could work for you?If your answer is YES!, please give me a call and let's chat!510.684.3939

Read More

Recent Posts